All Categories

Featured

Table of Contents

Picture having that rate of interest returned to in a tax-favorable account control. What opportunities could you capitalize on in your life with even half of that cash money back? The standard concept behind the Infinite Financial Idea, or IBC, is for people to take even more control over the funding and banking features in their everyday lives.

By having your buck do more than one work. Currently, when you spend $1, it does one thing for you. Maybe it pays a bill.

What if there was a technique that educates people exactly how they can have their $1 do than one task just by moving it through a possession that they manage? This is the significance of the Infinite Financial Principle, originally championed by Nelson Nash in his book Becoming Your Own Lender.

In his publication he demonstrates that by creating your own private "financial system" with a specifically developed life insurance policy contract, and running your bucks through this system, you can dramatically improve your monetary circumstance. At its core, the concept is as simple as that. Producing your IBC system can be carried out in a selection of imaginative means without changing your cash money circulation.

This belongs to the process. It takes time to expand a system to handle everything we want it to do. Assuming long-term is critical. Just bear in mind that you will be in financial scenario 10, 20 and even three decades from currently. To get there we need to begin someplace.

The payments that would certainly have or else mosted likely to a banking organization are repaid to your individual swimming pool that would have been used. The outcome? More money goes right into your system, and each buck is performing multiple work. Recapturing rate of interest and lowering the tax obligation problem is a fantastic tale. It obtains also much better.

Royal Bank Private Banking Infinite Visa

This money can be made use of tax-free. The money you utilize can be paid back at your leisure with no set settlement routine.

This is exactly how households pass on systems of riches that enable the next generation to follow their desires, begin services, and benefit from possibilities without shedding it all to estate and inheritance taxes. Corporations and financial institutions utilize this method to develop working pools of funding for their companies.

Walt Disney used this technique to begin his desire of developing a theme park for kids. A sound financial option that does not depend on a varying market? To have cash for emergency situations and possibilities?

Join among our webinars, or attend an IBC boot camp, all absolutely free. At no price to you, we will certainly instruct you much more concerning just how IBC functions, and produce with you a strategy that works to fix your problem. There is no obligation at any type of point while doing so.

How Does Infinite Banking Work

This is life. This is tradition. Contact one of our IBC Coaches quickly so we can reveal you the power of IBC and entire life insurance coverage today. ( 888) 439-0777.

We've been helping households, entrepreneur, and individuals take control of their financial resources for years (whole life insurance bank on yourself). Today, we're thrilled to review the fundamental principles of the Infinite Banking Idea. Whether you're handling personal funds, running a business, or preparing for the future, this principle supplies an effective device to attain monetary goals

A common misunderstanding is that boundless financial revolves around buying life insurance, yet it's actually regarding managing the procedure of funding in your life. Nelson Nash, in his publication Becoming Your Own Lender, makes this clear. The core idea is that we fund whatever we buyeither by obtaining cash and paying rate of interest to somebody else, or by paying cash and losing on the interest we might have earned somewhere else.

Some may claim they have an "boundless financial plan," however that's a misnomer. While certain policies are developed to execute the Infinite Financial Idea, Nelson discovered this procedure utilizing a standard entire life insurance plan he had actually bought back in 1958.

Nelson obtained a statement for his State Ranch life insurance coverage policy. He saw that for a $389 costs, the money value of the policy would certainly increase by almost $1,600.

This understanding noted the genesis of the Infinite Financial Idea. Numerous individuals remain at the grace of rising and fall rate of interest prices on home mortgages, home equity lines of credit, or service lendings.

Banker Life Quotes

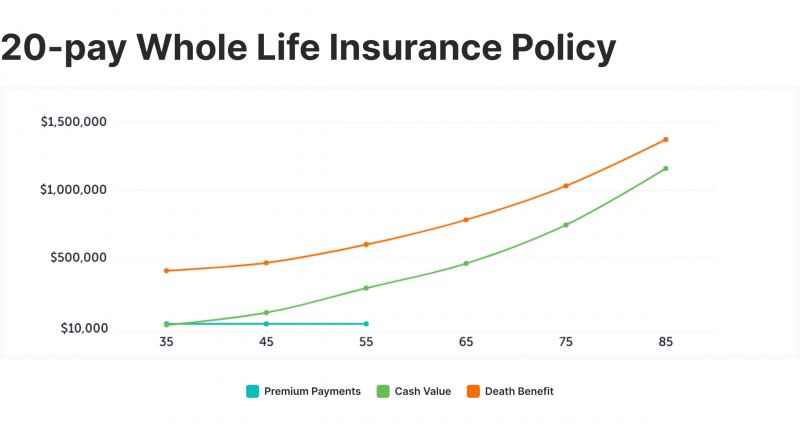

Nelson's insightcreating and regulating an individual pool of moneyallowed him to browse these challenges with self-confidence. Nelson acquired his policy for its fatality advantage. Over time, the cash money worth expanded, developing a financial resource he could tap right into via policy car loans. His history as a forester offered him a special long-term viewpoint; he thought in regards to years and generations.

Notably, this was not a temporary service. Nelson was spending in a plan that would not have cash worth for 2 or three years. But his long-term thinking paid offit essentially conserved him. This brings us to the essence of the Infinite Financial Concept: it has to do with how you utilize your money.

With your own swimming pool of cash, the opportunities are unlimited. Yet there's a crucial action: playing the honest banker. This indicates valuing your money the same means a bank values theirs. Whether you're obtaining from your plan or settling it, treat it as if you were dealing with a traditional loan provider.

The real power of this system lies in its versatility. Rate of interest change in time. When financial institution car loans went to 2-3%, some chose not to borrow versus their policies. As financial institution rates climbed up to 8-10% while plan loans remained at 5%, those with insight and a well-structured plan delighted in the freedom to borrow on a lot more favorable terms.

Notably, unlimited banking does not call for lifestyle sacrifices. It's concerning making smarter choices with the money you currently spend.

At its core, limitless banking permits one to utilize one's money value inside their entire life insurance coverage plan instead of relying on conventional financing from financial institutions or other lenders. "Insurance," in this instance, generally refers to, which covers a person's entire life (in comparison to, which just covers the insurance policy holder's recipients in the occasion of death).

Infinite Banking Insurance Policy

Insurance providers normally refine such requests without difficulty given that the security is already in their hands. They can quickly acquire it if the insurance policy holder defaults on their settlements. Most importantly, the system presents significant tax financial savings since rewards from cash-value life insurance policy plans are not subject to income tax.

Table of Contents

Latest Posts

Infinite Bank

My Own Bank

Infinite Banking System

More

Latest Posts

Infinite Bank

My Own Bank

Infinite Banking System